A customer who has taken out disability insurance refused to include the guaranteed pension increase in the event of a claim in the  insurance contract. The main argument from this customer was that the guaranteed pension increase was too expensive. Of course, the wishes of the customers must be accepted. However, the rejection of the guaranteed increase in pensions is regrettable insofar as the increase seems all the more important today.

insurance contract. The main argument from this customer was that the guaranteed pension increase was too expensive. Of course, the wishes of the customers must be accepted. However, the rejection of the guaranteed increase in pensions is regrettable insofar as the increase seems all the more important today.

Guaranteed pension increase in the event of disability

Most disability insurance policies include premium dynamics to adjust premiums and benefits. However, this premium adjustment ends automatically when the benefit event occurs. This is where the disadvantages of waiving the guaranteed pension increase begin. The guaranteed disability pension increase provides an assurance that the pension will be adjusted over time , providing full or partial inflation adjustment . Anyone who waives the guaranteed pension increase in the event of a claim must face a constant loss in value of their pension and a continuousaccept a loss of purchasing power . In addition, many insurance companies do not always generate surpluses that are passed on to customers in the form of appropriate profit participation. The companies have to pay the surpluses to the customer even if they take out disability insurance, but you don’t know how much the increase will have because the surpluses are not guaranteed . In general, one can say that in the event of a BU benefit, one gets an increase in the pension of around 1% pa.

Guaranteed pension increase in the event of a claim not overly expensive

Many customers who find out more about the insurance conditions find that the guaranteed pension increase in the event of disability is not overly expensive. However, they end up doing without it. A guaranteed increase in pension is particularly essential if the insurance contract is concluded for a period of 15 years or more. During this period, the risk of becoming unable to work increases significantly. The guaranteed pension increase in the event of a claim can make a decisive contribution to compensating for inflation-related disadvantages.

How do you find the right disability insurance?

Download my guide with the most important practical aids for selecting suitable insurance against occupational disability, this will make your selection easier:

Inflation and real loss of purchasing power

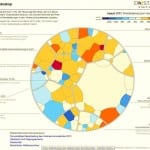

As can be seen from the sketch, the inflation rate was 1.5% in August 2013 . It must also be said that the inflation rate in 2013 is somewhat lower than in previous years. According to sources from the Federal Statistical Office, the average rate of inflation was 2.06% in the years 1982 to 2011 (=30 years) and 2.84% in the years 1967 to 2011 (=45 years).

As can be seen from the sketch, there are sometimes large differences within the individual consumer sectors . The highest inflation rates are found in the areas of leisure, entertainment and culture at 11.5% and in transport at 13.5%. In the area of goods and other services, the inflation rate is lower at 7.0%.

A numerical example is intended to demonstrate how the lack of a guaranteed pension increase in the event of occupational disability can affect it. With an annual inflation rate of 2%, a pension of EUR 2000 is only worth EUR 1330 after 20 years. If annual inflation is 3%, the loss of purchasing power is even greater. 2000 euros would then only be worth 1087 euros. For this reason, every person should, who would like to take out disability insurance, are thinking about a guaranteed pension increase .

more articles from our blog

Here are a few links to other articles on the subject of disability insurance:

- Preliminary risk inquiry for occupational disability insurance – what do you have to watch out for?

- Innovations Old Leipziger since 01.01.2015 at the BU

- Connection to occupational disability insurance in the event of incorrect advice

- Tips on choosing the right disability insurance

- BU rating – basis for secure protection against occupational disability

- Disability pension – how do you calculate the right amount?

- What are the two types of dynamics in disability insurance?

- Revocation dynamics – which deadlines must be observed?

Questions / further documents

If you have any further questions about the guaranteed pension increase in the event of occupational disability or would like a personal offer for BU protection, please send me an e-mail ( [email protected] ) or use my contact form .